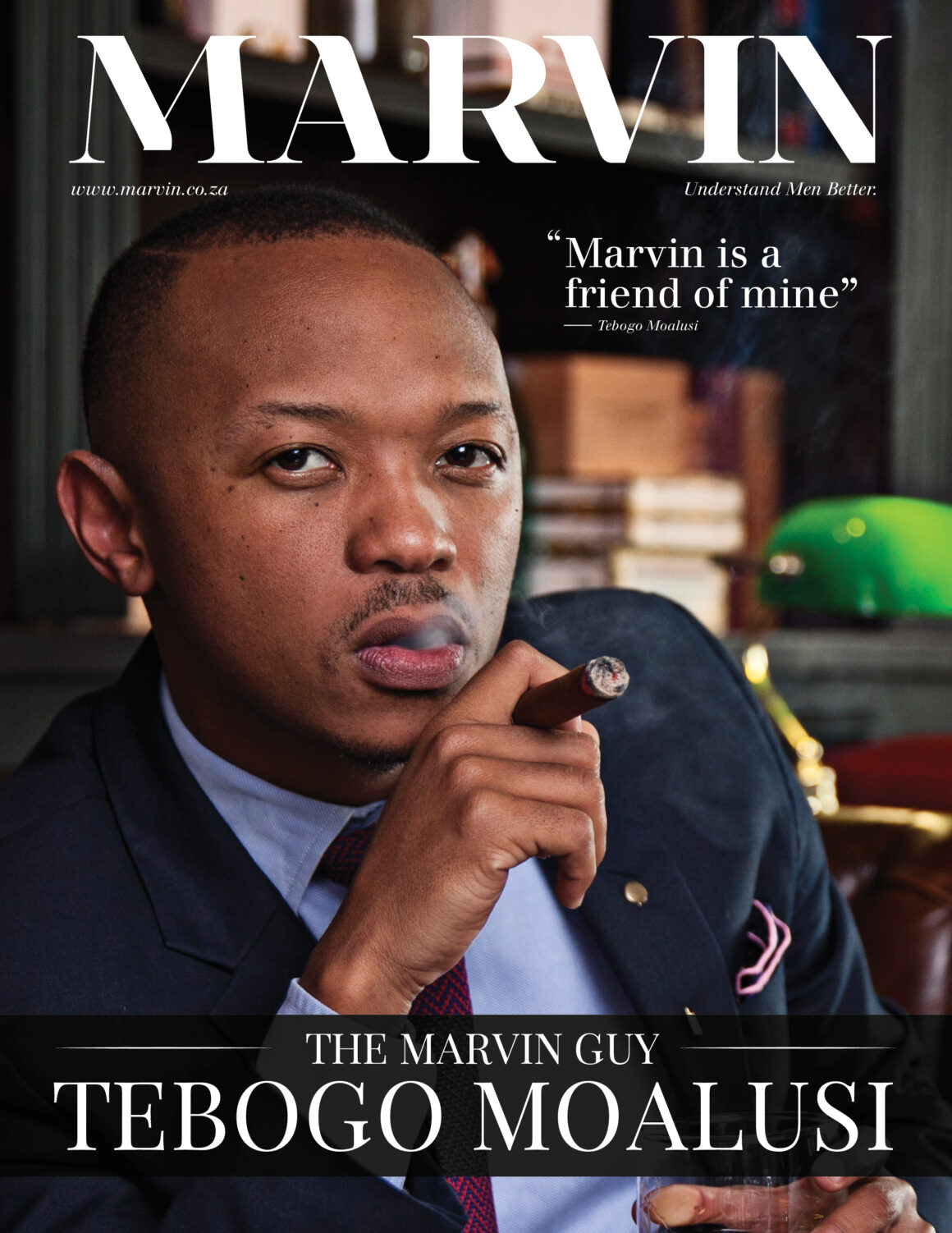

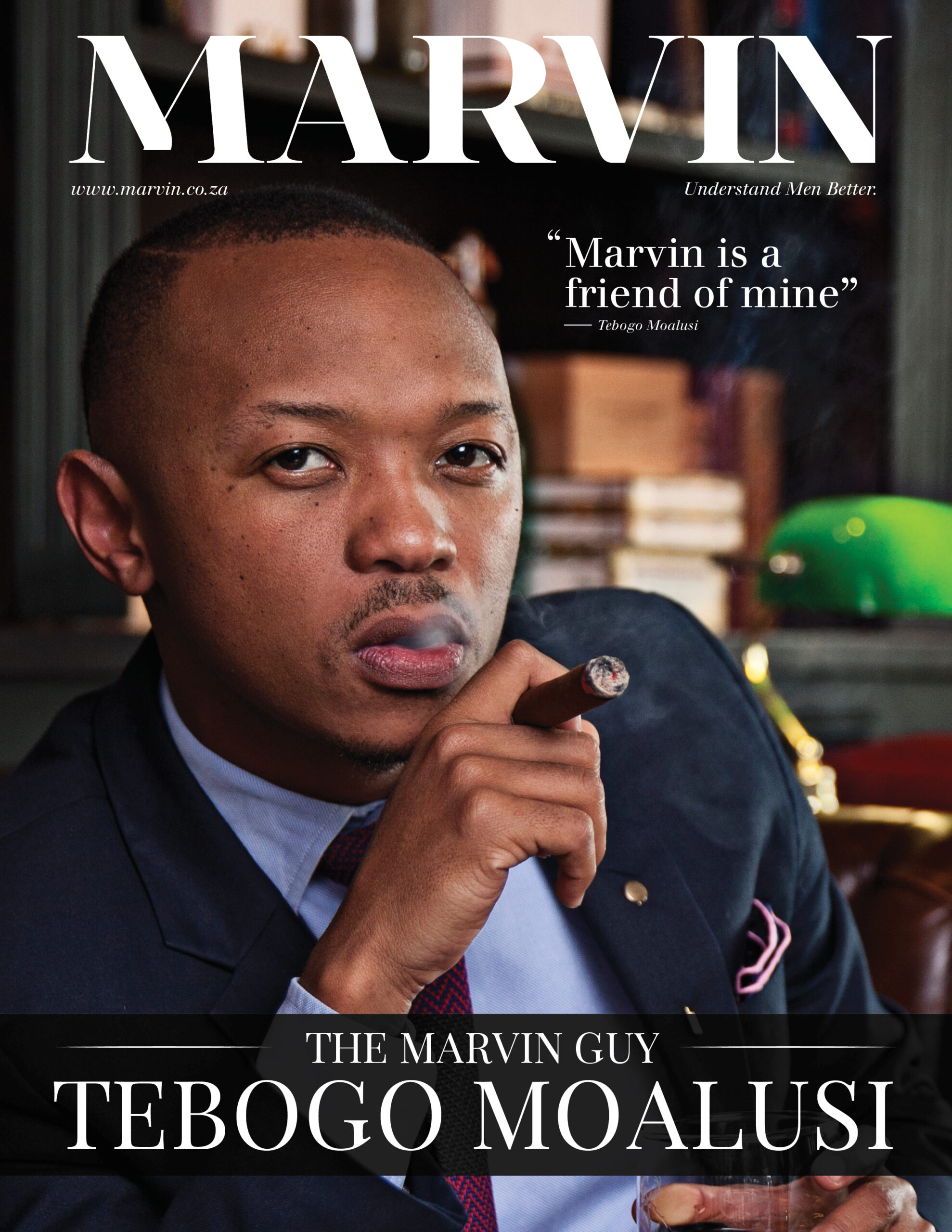

It is very difficult to pin down what exactly it means to be a modern man in 2015. The definitions are broad, varied and quite subjective yet so specific as to almost make a him a creature of myth. But what is ubiquitous with these checklists is a trait every man must possess: self-definition. Even the briefest glance at the career of Tebogo Moalusi and you will see it as the golden thread that seems to run through this young man’s tailored life.

He has worked in the financial services sector for the past 4yrs working for companies such as Investec. The talented Mr. Moalusi has also spent time accumulating accolades such as his nomination as SA Brightest Young Minds in 2007, Destiny Man Top 40 under 40 accolade in 2011 and he rocks an MBA in entrepreneurship from GIBS. You’d be forgiven for assuming that he might be a corporate juggernaut who spends daylight flexing his fiscal acumen in the boardrooms of some monolithic black glass skyscraper. This may be partly true. However, Mr. Moalusi has a passion for community development that is anything but detached from society. Not only is he a motivational speaker, focusing on Personal Branding and Personal Mastery, he has also founded the Young Professionals Forum (YPF) with the goal of empowering young professionals with a better ‘understanding of economic, social and political issues’ and developing the abilities through engagement. In 2008, he was co-founder of Bokamoso Cross Mentorship Programme. It is a youth focused development platform with the goal of holistically empowering high school learners with critical skills. To date, it has seen over 1000 grade 11 learners from seven different schools graduating through the programme. In 2015, the programme grew to KZN, now operating in 5 additional school in Durban and surrounding townships.

In contrast to the strait-laced life of corporate culture, Tebogo Moalusi also has a passion for creative industries and the Founding Executive Director of MNM Marketing Solutions, a marketing, brand activation and events management company. He is also part of a team of disruptors that is developing financial technology solutions through AlphaCode, a business incubator under the RMI Group in Sandton. This kind of approach to building one’s career offers a prime example of balancing a staunch understanding of corporate astuteness and a good grasp of the strength of youth culture. This makes him an imperative presence in the landscape of a country like ours: one full of youthful potential but in dire need for some form of economic reimagining.

We caught up with the man himself and he shared a few thoughts:

Could you please give us a brief insight into how you grew up?

Soweto born. Live in Pimville Zone 7 and Mofolo Central for most of my childhood. Amazing childhood. Although we were poor, we didn’t know any better. So what we had was enough. Moved to Zuurbekom at age 8. It was an Afrikaans farming community. Very different environment. But it was fun. We played with livestock, climbed peach and apricot trees and hunted birds. We then moved to Fourways and then Observatory, another major change. First time living in suburbs and quickly realising that we were not rich enough to enjoy some of the finest things in life. But it is here that I met my lifetime friends. That is where the leader in me was awakened. Growing up with both parents who are still married today has been a blessing. A stable family environment has been a game changer for me.

When you were still growing up, what did you dream of becoming?

A chartered accountant or economist.

From high school and tertiary, you seem to have always exhibited strong leadership abilities; was this a conscious effort on your part or were those around naturally gravitating in your direction?

Both. From my days at Sacred Heart College, I found myself dissatisfied with the status quo and wanting to be at the forefront of the solution. It is this attitude, I believe, that draws people to me and gives me the honour to lead them in pursuit of collective victory. I’m also blessed with the ability to speak confidently to large crowds in a way that connects with their minds and hearts.

What first drew you to the world of finance?

The lifestyle driven by propensity to earn well. I wanted to live a life of fast car, beautiful women, fitted suits, timepieces, glass and chrome houses by the beach and champagne.

Was varsity what you expected it be?

No. It was initially very daunting. I left for most of my friends in JHB to go to UCT and arrived not knowing many people. My family was also far away so I was on my own. I was humbled by the fact that in high school I was the cool jock who had power and influence. Landing at UCT, I was now a small fish in a very big pond. From 2nd year onwards, I found my feet and really enjoyed varsity. The freedom was refreshing. My final year was incredible. In that year, I was the best version of myself since Matric.

You career path has an almost palpable momentum to it. When do you draw your energy from to keep pushing at full speed?

The pursuit of experiencing the best version of myself. That’s what drives me. Many people tell me I have great potential. My drive comes from turning potential into tangible achievements that bring me joy, purpose and wealth. I’m also motivated by my family members and peers. I have some very talented and high performing friends who have ambitious goals. With the gifts that have been given to me, it’s my responsibility to be the best I can be for myself and others.

If there was is one piece of finance industry related advice that you would give your 16yr old self, what would it be?

Start saving and investing now. Experience the magic of compound interest.

Let’s talk about youth development. It comes across very strongly in a lot of the work that you do. What made you decide to make it such an integral part of how you operate as a brand?

A rising tide raises all ships. Youth development is that rising tide. I grew up in a family where selfless service is a core value. When I work with young people, I feel that there is an alignment between my personal purpose and what the country needs young people to be doing.

What do you feel are the greatest challenges facing the youth today?

On an individual level, I would say people are disillusioned. Some suffer from a confused sense of identity, lack of motivation and not understanding they’re self-purpose.

In terms of the youth as a collective, it is the lack of visionary leadership, being organised and having common goal coupled with the discipline to see it come to fruition.

What do you think of the recent student uprisings we have been seeing lately across campuses in the country?

An amazing and proud moment in history. It was a reminder to various stakeholders that the youth truly are a significant powerbase that can drive change. It has given us an opportunity to ventilate some key issues including unaffordable fee structure, frustration with government slow delivery on promises, over indebtedness of Black people at all levels and lack of support from private sector.

The moment also highlighted the power a non-partisan, principled and coordinate approach to protest. The young women and men at the forefront of this campaign were incredibly brave, disciplined and motivated. Some of the violent behaviour is again an exhibition of just how desperate some young people are. Although there are some opportunistic and criminal elements in this behaviour, significant portions of it are young people who have nothing left to lose.

Going forward, it becomes critical how the youth organise themselves to deepen the gains of the last few weeks, finding their true place at the table. Young people must innovate and be at the forefront of coming up with solutions to some of the challenges we face. It is a combination of leadership, coordination, solution driven approach and courage that we will really make an impact.

Do you believe that, from a financial industry point of view, the country can carry the revolt if the situation is not remedied soon?

Financial industry is a robust, resilient and sophisticated system. We have seen many challenges, which the industry has been able to absorb. The truth is, eventually things will stabilise because people run out of stamina and interest. What should be of interest to the industry is how government has called them out to make more of a contribution to society. Moreover, private sector should be aware now more than ever that at any point, the fight could be brought to them. They need to decide how proactive hey will be in heeding the call to do more for South Africa. What we saw yesterday from the EFF and what we heard in parliament is the beginning of a revolution.

What is your opinion on the concept of ‘Black Tax’?

Its real. Black people are required to make a rand go further. As an extension of apartheid, Black families inherit structural challenges which make life more expensive. Travelling to work is one of the major costs. Most Black people who are employed live far from economic hubs, spending significant time and money travelling. Other commitments for employed and unemployed Black people include assisting with groceries, school fees, medical bills and cellphone bills. Typically, Black families are living in larger groups, with fewer people employed per household. The burden on the primary breadwinner is enormous.

What are the 3 most imperative personal branding tips that you can share with anyone who wants to make a success of their talents?

Define your personal value proposition and uniqueness very clearly. This is reflected in how you people view your contribution, which determines how you build a premium on your value.

Have the discipline to build and communicate this value proposition consistently to the correct target audience using a number of mediums or platforms.

Continuously invest in your personal growth so that you can have a deeper and broader value proposition. This will enhance your perceived value and premium.

Writer: Vus Ngxande Photographer: Ricardo Marcus Creative Director: George Gladwin Matsheke