2020 has been an excellent year for both Shopify & Amazon, well the whole e-commerce platform movement (Magento, Big-commerce, Woo-commerce, Ecwid, etc.). Still, undoubtedly Amazon is the Goliath & Shopify sells swords to a bunch of Davids. The analogy fits the two. Both platforms have had magnitudes of success for various reasons. Amazon has been the bedrock of the American internet of commerce (AiOC, laugh with me if you get the reference) & Shopify has allowed a plethora of businesses to quickly pivot from only having a physical retail presence to one that incorporates e-commerce as well.

Amazon – the 2 Trillion dollar company

There was an outcry on the 20th of July when jeff Bezos added 13 billion dollars in a day to his net worth. But what happened that day to cause such a drastic increase in Jeff’s net worth? — An analyst at Goldman Sachs increased the price target of Amazon to $3800 a share. What’s the price target? It’s basically what an analyst believes the share price of a particular company will reach in 12-18 months. Because Goldman Sachs is considered the smartest shop on the street, $3800 was the highest price target & every individual on the sidewalk decided to buy Amazon stock, which caused an 8% bump in the share price increasing Mr Bezos’s dollars by 13 billion — at least on paper. But the real question is why? Why is Amazon stock deemed more valuable than an ounce of gold? — The answer to this question is vital in understanding the long term play Naspers is taking with Takealot.

In Q2, Amazon’s revenue was up 40% to $88.9 billion & profits were sitting at a cool $5.2 billion, breaking the quarterly profit record of $3.6 billion set in Q1. Just Stripping out the AWS revenues & other revenues & focusing on the marketplace & e-commerce business only — $74.38 billion. Amazon prime’s subscription service was up 29% to $6.02 billion. There’s no doubt that Amazon owns the American consumer on the internet, but the reason they continue to grow is the cumulative growth of e-commerce from ‘convenience’ to necessity.

Amazon vs Walmart & the field

“The global retail market we compete in is strikingly large and extraordinarily competitive. Amazon accounts for less than 1% of the $25 trillion global retail market and less than 4% of retail in the U.S. Unlike industries that are winner-take-all, there’s room in retail for many winners” – Jeff Bezos

The first thing Jeff points to when Amazon gets called a monopoly is Walmart.

Amazon competes against large, established players like Target, Costco, Kroger, and, of course, Walmart—a company more than twice Amazon’s size. – Jeff Bezos

In his statement to the House Committee on Judiciary, Jeff points to Walmart’s e-commerce effort as well as other major retailers growth in online sales:

- In Q1, Walmart’s e-commerce sales increased by 74%, while in-store sales rose by 10%.

- Target’s e-commerce sales increased by 100% in Q1 & by 275% alone in April.

- Costco saw e-commerce sales increase by 108% in May.

Jeff also points to the retail footprint of these retailers; specifically, advantages in presence for curbside pick up & click & collect. Even so, commerce on the internet is Jeff’s playground — Amazon has a market share of approximately 47% of e-commerce sales in America. The closest amongst the retailers is Walmart with 7%. The bet is that e-commerce will outgrow physical retail & that is the long term play.

But that does not tell the true story of e-commerce. The problem the House Committee sees is not how Jeff sees it. It’s not a story of Amazon vs Walmart & the field. It’s Amazon vs small business to them, the ones who choose to sell on Amazon’s marketplace & those who choose to have their unique brands built on Woo-commerce & Shopify.

Woo-commerce, Shopify & the rebels in arms.

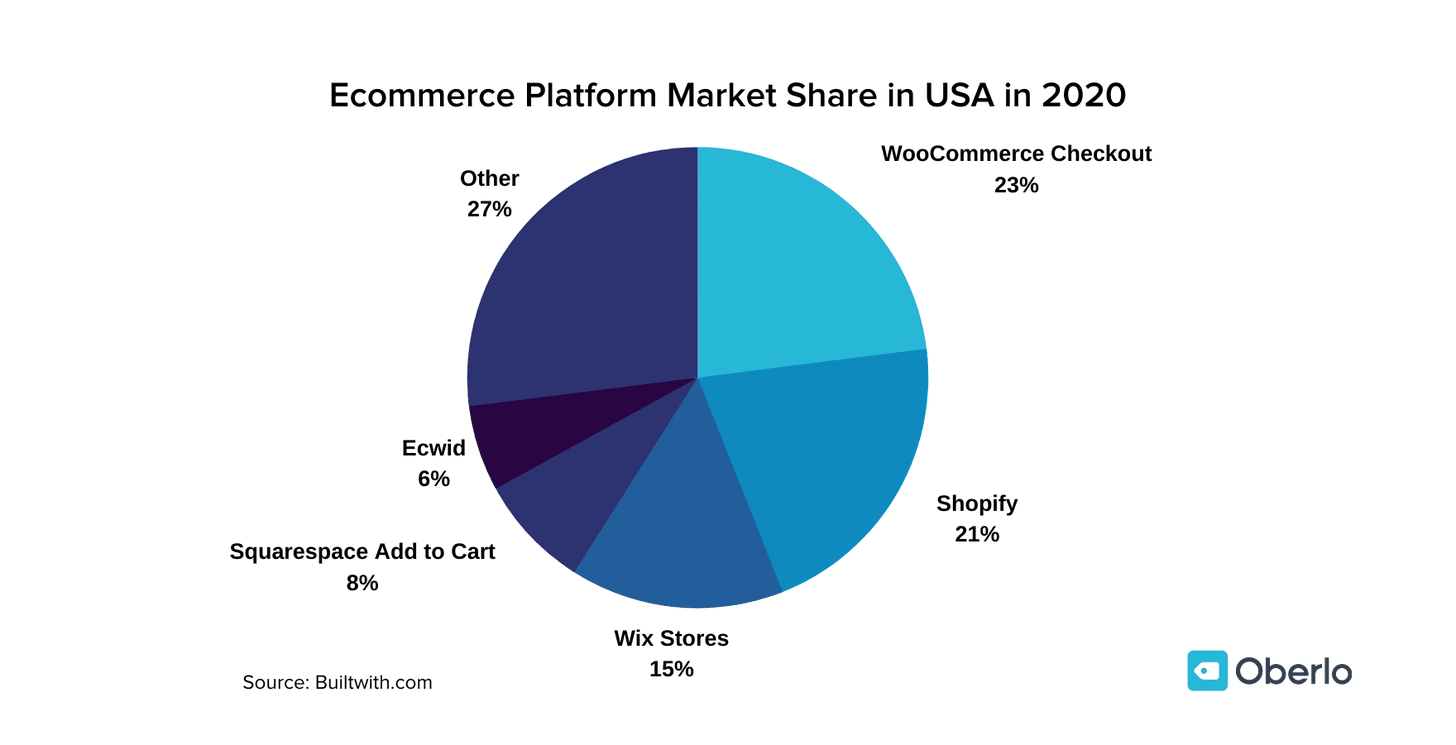

Woo-commerce, the company which came out of Woo-themes, founded by South Africans Adii Pienaar, Mark Forrester & a Norwegian, Magnus Jepson. If you don’t know Woo-commerce, it’s a plugin that allows you to convert your WordPress website into an e-commerce store. Shopify is a Canadian based company that gives businesses of all sizes the tools to build e-commerce stores — founded in Ottawa, Canada by Tobi Ludke, Daniel Weinand, & Scott Lake. Together these companies power over 40% of the e-commerce stores in the USA.

According to Shopify, small businesses globally are adapting to the problems caused by COVID. Gross merchandise volume grew 46%. Initially, they saw sales for businesses with a physical store presence drop by 71%, but those businesses quickly adapted & replaced 94% in-store revenue with e-commerce. In English speaking markets, 26% of brick-n-mortar stores (physical stores) are using what keeps Jeff Bezos up at night — curbside pickup & click & collect to drive sales.

In its quest to arm the rebels (small businesses) against the giant of Amazon, Shopify partnered with Facebook to launch Facebook Shops, further strengthening the relationship between these two companies.

This is just a few things that Shopify has launched to further help small businesses around the world. Shopify is the one that gets the most press, but all of the platforms in that pie diagram are playing their part in arming the rebels against Amazon.

But Amazon still has the upper hand in America. They have done the long yards of aggregating demand & exert immense power in their marketplace. The same marketplace that got Jeff Bezos called in to answer questions about antitrust in front of the House Judiciary Committee.

China – Livestream sales, Alibaba & Pinduoduo

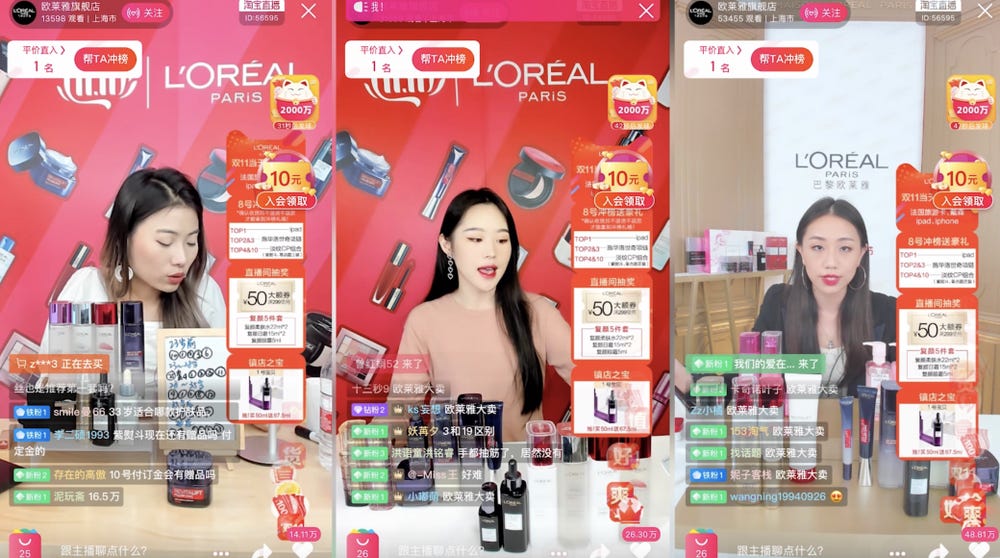

While this was going on in the West — in China, e-Commerce was business as usual with an added twist — Livestream e-commerce. Livestream e-commerce is, as it sounds, purchasing products directly within a live stream. Imagine you are in a Zoom meeting & a colleague tags the vase behind them with a purchase price & starts selling it to anyone in the Zoom meeting.

source: contagious.com

Sounds pretty much insane right? Not really, according to a research firm called iResearch, Livestream e-commerce in China is on path to double this year from $62 billion last year.

But as a total value of e-commerce sales, Livestream is relatively minute. Alibaba continues to control over 50% market share in e-commerce. Together, Alibaba, JD.com & Pinduoduo control 80% of the e-commerce market. We all know Alibaba, but the majority of people don’t know JD.com & the new kid on the block, Pinduoduo.

Pinduoduo — in English means together, more savings, more fun. The company was founded in 2015 as a social commerce platform for farmers & is one of the fastest-growing companies in the world. The company went from 0 to $100 billion in market capitalization in 5 years. To simply explain what Pinduoduo is — Imagine it was Black Friday; every day. If you want to learn more about Pinduoduo, you can read the breakdown from Turner’s substack or listen to a podcast about the company by Acquired.fm. I would do a disservice to try to explain it further.

What about e-Commerce in South Africa?

While the world of e-Commerce was trying to keep up with demand, every form of commerce besides large food retail was banned in South Africa. Kim Ried, the CEO of Takealot, could be seen perplexed on Techcentral’s podcast with Duncan McCleod. It feels like a missed opportunity in hindsight. A lack of understanding by the office of the Minister of Economic Development restricted e-commerce trade & the ability to adapt early for not only small businesses but large non-food retail as well.

But then again, e-commerce is a small, small, small part of total retail in South Africa. According to Arthur Goldstruck’s research firm World Wide Worx, total e-commerce sales in 2018 accounted for 1.4% of total retail sales in South Africa, just over R14 billion in total value. R14 billion would be considered a lousy quarter by Shoprite’s former CEO, Whitey Basson. Depending on who you ask, e-commerce growth in South Africa pre-COVID was between 20-30% year-on-year.

According to eCommerceDB, Takealot was the biggest mover of products on the internet followed by Makro, then Builders.co.za, Woolworths & Nike in 2018/19.

Level 5

Over the COVID period, there has been a surge in online grocery shopping with Checkers & Pick n Pay leading the charge. The growth was due to working from home situations, fear & large awareness of third party delivery services. Checkers found a surge in growth from mid-to-upper-middle-class shoppers. People found out about their best-kept secret: Checkers Food Services, the bulk buying division that delivers:Leigh van den Berg @lipglossgirlI recently found out that @CheckersSA has a Makro-style bulk buy website called CFS where you can snap up rad deals like ONE HUNDRED AND SIXTY Cadbury Flakes for R2,74 each 👀👀👀 You’re welcome! eshop.checkersfs.co.za/choc-flake-99-…

January 23rd 202035 Retweets153 Likes

While this was happening, Takealot CEO Kim Reid was still complaining on Techcentral. You see, Naspers, Kim Reid & I know that the Takelot’s biggest competition is not armed rebels, but Shoprite-Checkers. Like Amazon vs Walmart, Shoprite has distribution leverage in the form of its retail footprint but more importantly — distribution centres.

Shoprite-Checkers Online will be massive. If Shoprite-Checkers decides to take the Walmart.com approach with a marketplace for retail — Takealot will not be able to build distribution centres fast enough to compete. That’s why Takealot getting distribution is important for Naspers.

Level 4 & 3

Nevertheless, Takealot adapted fast to the lockdown, selling essential services where they could. Jumia, the largest e-commerce operation in Africa, quietly launched its South African operations, taking over from Zando. It became a scramble for small businesses to pivot & shift focus to e-commerce.

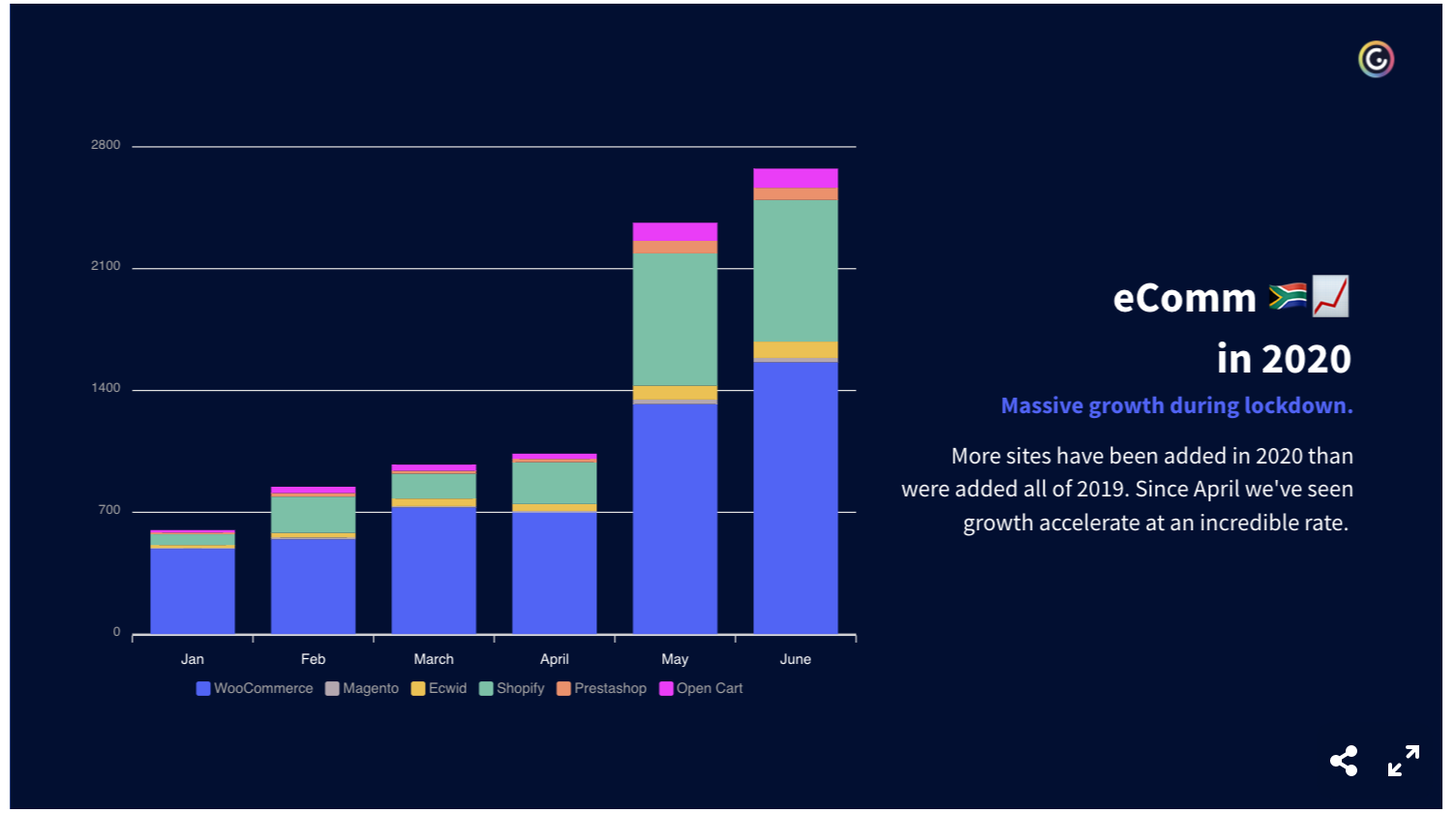

According to a report done by a new site called ecomm.africa, there has been a 306% increase in e-commerce stores from June 2019 to June 2020. The big bump came in May, likely due to the restrictions moving from level 4 to level 3.

Source: ecomm.africa

Payment providers too adapted; Flutterwave, a Nigerian founded payment infrastructure company launched Flutterwave Stores. South African giant Yoco launched Yoco Online; several payment solutions for its 80 000 merchant base, including a payment gateway for Woo-commerce. Peachpayments raised some capital & Payfast saw YoY growth reach 83% in April.

Now & the future

There are now over 54 000 e-commerce stores in South Africa. But e-commerce penetration as a total of retail sits at 2%. Doing business online is not easy; there are a lot of things you need to consider when starting an e-commerce store; acquiring customers, marketing, logistics, payments, packaging, etc. There is no doubt that COVID has accelerated e-commerce growth, but the best approach will always be omnichannel & meeting customers where they are.